Introduction: In today's consumer-driven world, it's easy to accumulate expenses that drain your budget without adding real value to your life. The key to financial wellness often lies not in earning more, but in spending smarter. By identifying and eliminating unnecessary expenses, you can free up money for savings, investments, or the things that truly matter to you.

1. Track Every Purchase for One Month

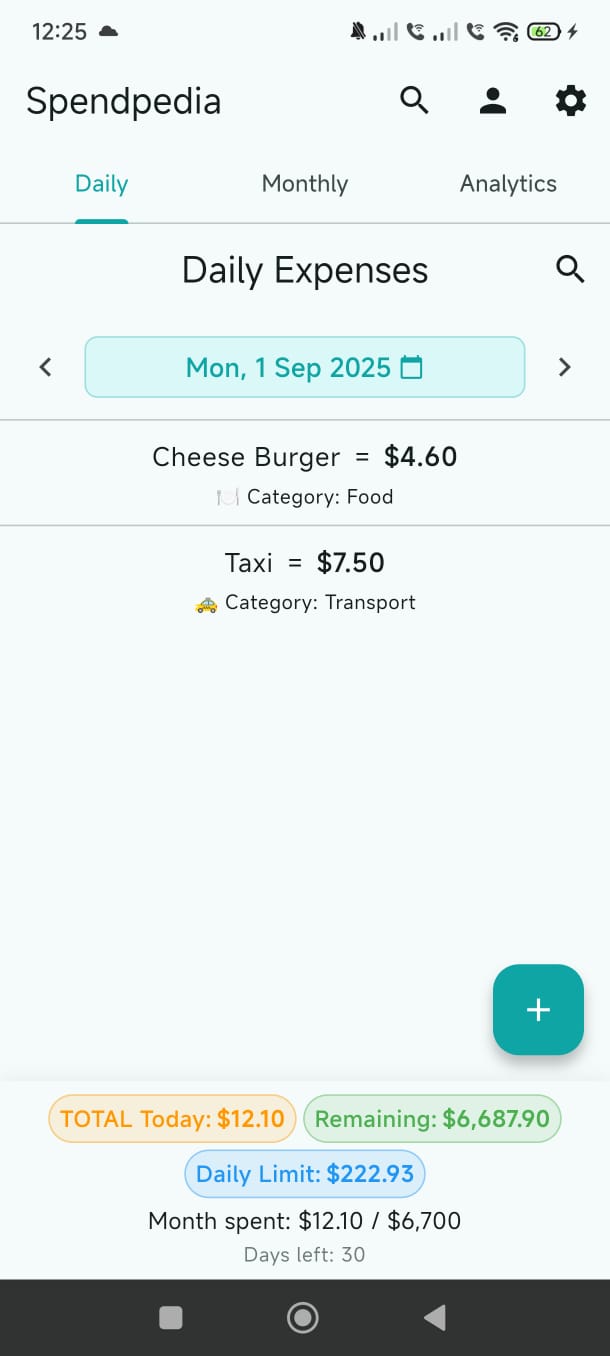

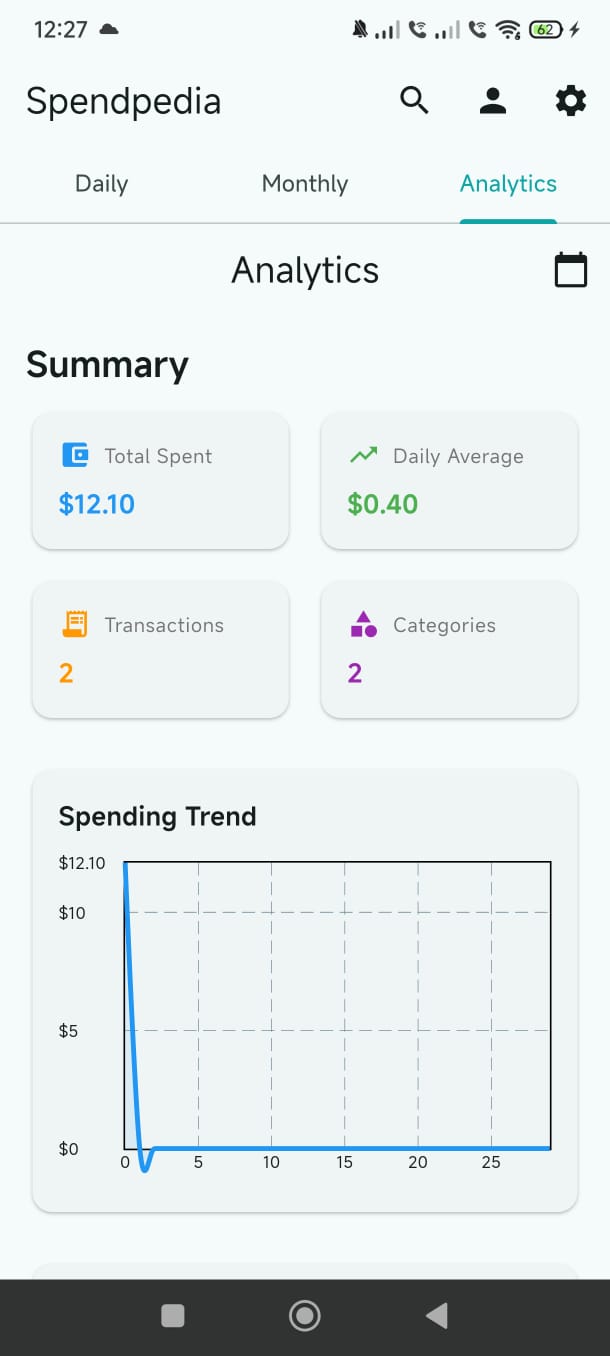

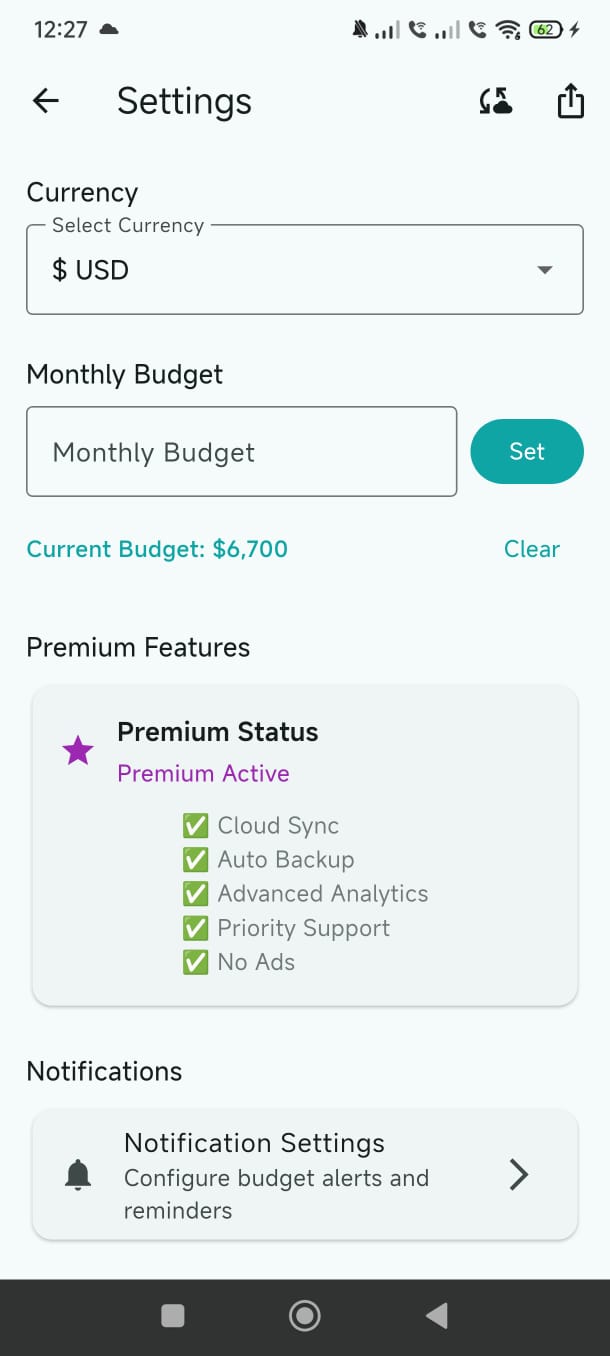

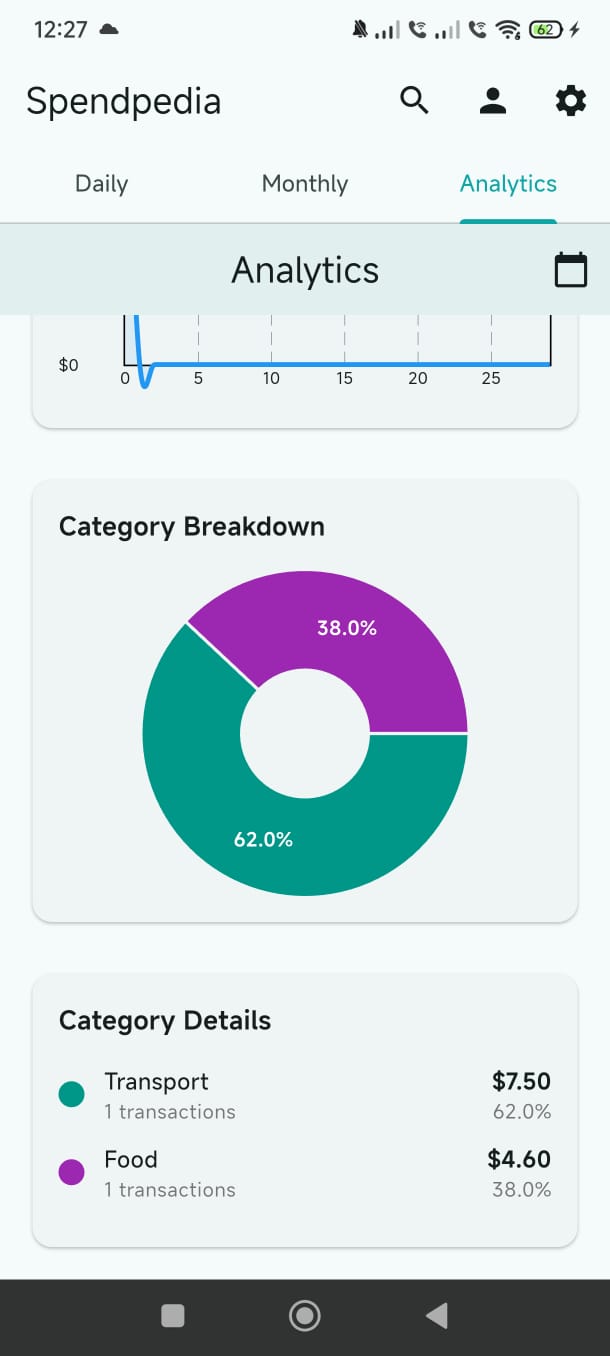

Before you can cut expenses, you need to know where your money goes. Use a spending tracker app like Spendpedia or simply write down every purchase for 30 days. You'll be surprised by how much you spend on small, seemingly insignificant items that add up over time. Coffee shops, vending machines, and impulse purchases often reveal themselves as major budget drains.

2. Apply the 24-Hour Rule

For any non-essential purchase over $50, wait 24 hours before buying. For larger purchases over $200, wait a week. This cooling-off period helps you distinguish between wants and needs. Often, you'll find that the urge to buy passes, saving you money on items you didn't really need.

3. Review Subscriptions Quarterly

Subscription services are modern budget killers because they're easy to forget. Every three months, review all your recurring charges – streaming services, gym memberships, magazine subscriptions, software licenses. Cancel anything you haven't used in the past month or can live without.

4. Shop with Intent, Not Impulse

Always shop with a list and stick to it. Avoid browsing shopping websites when bored, and unsubscribe from promotional emails that tempt you with deals you don't need. Consider the cost-per-use of items before purchasing – a $100 jacket worn once a week for a year costs $2 per wear, making it a better investment than a $30 shirt worn only twice.

5. Find Free or Low-Cost Alternatives

Look for free alternatives to paid services. Use library books instead of buying, try free fitness videos instead of expensive gym memberships, or explore free community events for entertainment. Often, these alternatives provide equal or better value than their expensive counterparts.

Conclusion: Cutting unnecessary expenses doesn't mean living frugally or depriving yourself of enjoyment. It's about being intentional with your money and ensuring every dollar spent aligns with your values and goals. Start with one or two of these strategies and gradually incorporate others. Even small changes can lead to significant savings over time, giving you more financial freedom to pursue what truly matters to you.